![]() {{item.Name}}

{{item.Name}}

{{item.Description}}

{{item.Name}}

Products

![]() {{item.Name}}

{{item.Name}}

![]() {{item.Name}}

{{item.Name}}

{{model.SelectedProduct.FullTitle}}

{{model.SelectedProduct.ProductInfo}}

Pacific Life Insurance Company

{{model.SelectedProduct.FullTitle}}*

Lincoln MoneyGuard® II

Term insurance for up to $350,000 that is easy to obtain and requires no medical exam.

Did You Know?

83% of consumers say they don’t purchase more life insurance because it’s too expensive, but consumers believe life insurance costs nearly 3 times the actual price.Universal life insurance is a flexible low-cost plan to provide protection for your entire life.

Did You Know?

40% of Americans who have life insurance coverage don’t think they have enough.Life insurance coverage at a fixed cost for a specific period of time.

Did You Know?

Less than half of American households have an individual life insurance policy.Term life insurance that offers coverage riders that can be added to allow a customized term solution that decreases and gets less expensive over time.

Did You Know?

95% of financial plans recommend a life insurance coverage need greater than what clients already have in place.Term life insurance offered with a possible abbreviated (non-med) underwriting process for up to $1,000,000 in coverage.

Did You Know?

95% of financial plans recommend a life insurance coverage need greater than what clients already have in place.Term life insurance offered for up to $500,000 in coverage.

Did You Know?

95% of financial plans recommend a life insurance coverage need greater than what clients already have in place.Life insurance guaranteed for the insured’s entire life.

Did You Know?

The value of a whole life insurance policy is uncorrelated to the stock market and is largely guaranteed by the insurer, so that neither death benefits nor cash values are affected by declining markets.Insurance to help provide for cost of long-term care that generally is not covered by health insurance, Medicare, or Medicaid.

Did You Know?

70% of people will need some form of long-term care after age 65.Lump sum disability provides income protection in the form of a single payout equal to your annual income up to $100,000.

Did You Know?

Disability is the number one cause of bankruptcies in the U.S.Short-term disability insurance provides income in the event one becomes disabled and cannot work, up to a maximum of $5,000 per month.

Did You Know?

One in four will become disabled before they retire.Long-term disability insurance provides income in the event one becomes disabled and cannot work, up to a maximum of $20,000 per month.

Did You Know?

One in four will become disabled before they retire.SBA term life insurance is expedited issue term life insurance required by SBA lenders.

Did You Know?

Life Insurance is mandated for SBA borrowers. The average SBA loans takes 43 days to place, but the average life insurance policy takes 75 days to place.Whole life coverage that is easy to obtain and requires no medical exam.

Did You Know?

Half of Americans say they couldn’t survive a year without the primary wage earner’s income.Guaranteed issue whole life coverage for children who are 14 days to 17 years old.

Did You Know?

A whole life policy for a child can provide a head start in saving for college.Life insurance that pays a death benefit if death occurs as a result of an accident.

Did You Know?

Accidents are the fourth leading cause of death in the U.S.Ten years of premiums to provide guaranteed life insurance.

Did You Know?

Cash value in a life insurance policy grows on a tax deferred basis.Life insurance designed to combine death benefit with early access to high cash values.

Did You Know?

Industry experts have found that insureds are 2x more likely to surrender or exchange their life insurance policy prior to death.Life insurance guaranteed for the insured’s entire life with only a single lump-sum premium payment.

Did You Know?

Death proceeds from life insurance are tax free to beneficiaries.Changing from a term policy to a permanent product without proving insurability.

Did You Know?

40% of all insureds consider themselves "Orphan clients", meaning policy holders who don’t have anyone to serve them.Term insurance for up to $250,000 that is easy to obtain and requires no medical exam.

Did You Know?

83% of consumers say they don’t purchase more life insurance because it’s too expensive, but consumers believe life insurance costs nearly 3 times the actual price.Grow your cash value immediately and transfer your asset to the ones you love.

Did You Know?

Life insurance can be a tax-advantaged way to transfer wealth to future generations; based on current tax laws.Liberty Series Estate Maximizer Next Generation is an innovative, single payment interest-sensitive whole life insurance product that offers a guaranteed death benefit larger than the single payment, making it a great solution for asset transfer.

Did You Know?

Life insurance can be a tax-advantaged way to transfer wealth to future generations; based on current tax laws.Life insurance coverage at a fixed cost for a specific period of time.

Did You Know?

25% of people wish their spouse or partner would purchase some or more life insurance.Product that combines the value of life insurance and long-term care benefits together in one product.

Did You Know?

40% of LTC benefits are paid to people under age 65.Flexible premium policy designed for death benefit protection with competitive long-term cash value accumulation.

Did You Know?

Two in three Americans are worried about insufficient retirement savings; partly due to qualified retirement plan contribution limits.Life insurance coverage at a fixed cost for a specific period of time.

Did You Know?

25% of people wish their spouse or partner would purchase some or more life insurance.Life insurance coverage at a fixed cost for a specific period of time.

Did You Know?

25% of people wish their spouse or partner would purchase some or more life insurance.Life insurance coverage at a fixed cost for a specific period of time.

Did You Know?

25% of people wish their spouse or partner would purchase some or more life insurance.Universal life insurance is a flexible low-cost plan to provide protection for your entire life.

Did You Know?

Only 44% of Americans own an individual life policy.Product that combines the value of life insurance and long-term care benefits together in one product.

Did You Know?

40% of LTC benefits are paid to people under age 65.Product that is offered on an abbreviated (non-med) underwriting basis for up to $500,000 in coverage.

Did You Know?

25% of people wish their spouse or partner would purchase some or more life insurance.Index Universal Life insurance can meet a number of client needs and has a flexible payment option that allows for multiple funding options to meet a wide range of client objectives.

Did You Know?

Two in three Americans are worried about insufficient retirement savings, partly due to the contribution limits of most qualified retirement plans.Current Assumption Universal Life insurance can provide protection for the rest of your life, and has the potential to accumulate cash value while offering a flexible payment plan.

Crediting to the policy is determined by the carrier and is not tied to a market index.

Product that combines the value of life insurance and long-term care benefits together in one product. This product will be a quote request to your Covr Insurance Sales Team.

Did You Know?

One out of three individuals over age 85 suffer from Alzheimer’s.1Product that combines the value of life insurance and long-term care benefits together in one product.

Did You Know?

At least 70% of people over 65 will need long-term care services and support at some point in their lives.Product that combines the benefit of long term care with the value of life insurance protection in one product. This product will be a quote request to your Covr Insurance Sales Team.

Did You Know?

40% of LTC benefits are paid to people under age 65.Premier Accumulation Universal Life provides protection and growth in one product.

Did You Know?

7 out of 10 American households would have trouble covering everyday living expenses within a few months if the primary wage earner died.Term coverage that can be issued through an abbreviated underwriting process.

Did You Know?

48% of underwriting cases are issued in less than a week and do not require medical exams.Talk to an expert {{model.SelectedProduct.Phone}}

This product is great for clients looking for the following:

- Need benefit amount of $350,000 or less

- Do not want to go through a medical exam (blood and urine test)

- Easy and quick process to purchase insurance

- Coverage for their entire life

- The ability to make premium payments in a flexible manner

- The lowest cost of protection for their entire life

- Lowest possible cost for coverage

- Coverage for a specific period of time

- Coverage for a specific period of time

- Flexible coverage amounts to help fit specific needs

- Ability to buy one policy and have it decrease in both cost and coverage over time

- Low cost for coverage

- Coverage tailored to a specific need such as a financial plan or mortgage

- Coverage for a specific period of time

- Digital Process

- Competitive rates

- The opportunity to possibly not through a medical exam due to overall good health when applying for less than $1,000,000 of coverage

- Quick and easy process to purchase life insurance

- Don’t want to hassle with medical exams

- The ability to buy online, instantly

- Purchasing coverage with a credit card

- Quick and easy purchasing process

- Lowest possible cost for coverage

- Coverage for a specific period of time

- And those who can answer No to the following four questions and who fall within the build chart parameters defined below

-

Within the past 24 months has your client been:

- Declined by another life insurance carrier?

- Hospitalized for psychiatric or medical reason (other than orthopedic related injury)?

- Filed for bankruptcy?

- Disabled or collected Social Security Income benefits for more than six months?

- In the past 10 years has your client been charged with a felony conviction, DUI, or reckless driving?

- Has your client ever sought or received advice, counseling or treatment for the use of alcohol or drugs, including prescription drugs?

- Has your client received treatment for or been prescribed medication for any of the following conditions in the past 5 years?

- AIDS

- ALS

- Anxiety

- Bi-Polar Disorder

- Brain Tumor

- Cancer

- Central Nervous Disorder

- Chronic Pain

- Chronic Kidney Disease

- Cirrhosis

- Dementia

- Depression

- Diabetes

- Heart or Circulatory Disorder

- Hepatitis C

- Leukemia

- Lupus

- Schizophrenia

- Stroke

- Suicide Attempt

- Respiratory Disorder

- Terminal Illness

| Ages 18-44 | Ages 45-60 | ||||||

|---|---|---|---|---|---|---|---|

| Height | Weight | Height | Weight | Height | Weight | Height | Weight |

| 4'8 | 79-129 | 5'9 | 119-197 | 4'8 | 79-132 | 5'9 | 119-200 |

| 4'9 | 81-134 | 5'10 | 122-202 | 4'9 | 81-136 | 5'10 | 122-206 |

| 4'10 | 84-139 | 5'11 | 126-208 | 4'10 | 84-141 | 5'11 | 126-212 |

| 4'11 | 87-144 | 6'0 | 130-214 | 4'11 | 87-146 | 6'0 | 130-218 |

| 5'0 | 90-149 | 6'1 | 133-220 | 5'0 | 90-151 | 6'1 | 133-224 |

| 5'1 | 93-154 | 6'2 | 137-226 | 5'1 | 93-156 | 6'2 | 137-230 |

| 5'2 | 96-159 | 6'3 | 141-232 | 5'2 | 96-161 | 6'3 | 141-236 |

| 5'3 | 99-164 | 6'4 | 144-239 | 5'3 | 99-169 | 6'4 | 144-243 |

| 5'4 | 102-169 | 6'5 | 148-245 | 5'4 | 102-172 | 6'5 | 148-249 |

| 5'5 | 106-174 | 6'6 | 152-251 | 5'5 | 106-177 | 6'6 | 152-256 |

| 5'6 | 109-180 | 6'7 | 156-258 | 5'6 | 109-183 | 6'7 | 156-262 |

| 5'7 | 112-185 | 6'8 | 160-264 | 5'7 | 112-194 | 6'8 | 160-269 |

| 5'8 | 116-191 | 6'9 | 164-271 | 5'8 | 116-194 | 6'9 | 164-276 |

- Coverage for your entire life

- Coverage and cash value guaranteed

- Guaranteed level cost

- The ability to build tax-advantaged cash value in your life insurance policy

- Want to protect their assets/estate

- Have assets greater than $75,000

- Are up to age 79

- Need benefit amount of $100,000 or less

- Financial protection for up to one year’s worth of salary in the event of a disability

- Looking for a simple underwriting process and product

- Need benefit amount of up to $5,000 per month

- A simple underwriting process and product

- Short-term financial protection in the event of a disability

- Need benefit amount of up to $20,000 per month

- Long-term financial protection in the event of an extended disability

- A simple underwriting process and product

- Longer-term protection, over 2 years

- Life insurance coverage related to borrowing from an institution under the SBA program

- Coverage for a specific period of time at a low cost

- An expedited underwriting process

- Coverage for your entire life

- Do not want to go through a medical exam (blood and urine test)

- Coverage and cash value guaranteed

- Guaranteed level cost

- Simplified underwriting

- Coverage for their entire life

- To pay a single, lump-sum premium

- Coverage and cash value guarantee

- Tax-deferred growth and accumulation

- A tax-advantaged way to pass on wealth

- Parents, grandparents, and permanent legal guardians looking to give the gift of insurability

- Guaranteed protection for the insured

- Starting a savings plan early in life that can keep giving

- Guaranteed future insurance for the insured

- Life insurance death benefit coverage for a specific period of time

- Lower cost of life insurance coverage

- Flexible convertibility options for the life insurance coverage

This product may be great for clients looking for the following:

- Concerned regarding the potential cost of Long-Term Care expenses

- Want to protect their assets/estate

- Want a single premium product

- Death benefit if no long term care is needed

- Concerned about return of premium

- Concerned regarding the potential cost of Long-Term Care expenses

- Want to protect their assets/estate

- Want a limited pay product

- Death benefit if no care is needed

- Guaranteed premium; no risk of increases

- Concerned about ability to refund cost of product

This product is great for clients looking for the following:

- Product with potential gains tied in part to performance of major stock market indexes, but guarantees protection against market based losses

- Coverage and cash value

- Tax-deferred growth and accumulation

- Professional who plans to wait 15 or more years until first planned distribution

- Want to fund with moderate to high premiums

- Executives looking for a supplemental retirement strategy

This product is great for clients looking for the following:

- Coverage for a specific period of time

- Express underwriting available

- Low cost for coverage

This product is great for clients looking for the following:

- Coverage for a specific period of time

- Express underwriting available

- Low cost for coverage

This product is great for clients looking for the following:

- Coverage for a specific period of time

- Express underwriting available

- Low cost for coverage

- Coverage for their entire life

- Express underwriting available

- The ability to make premium payments in a flexible manner

- The lowest cost of protection for their entire life

- A simple application process and guaranteed acceptance

- Do not want to go through a medical exam (blood and urine test)

- Affordable coverage

- Coverage for their entire life

- To only pay premiums for a limited number of years

- Coverage and cash value guaranteed

- Tax-deferred growth and accumulation

- Long-term accumulation vehicle with exceptional safety and predictability

- Long-term cash value available for income needs

- A product that offers high cash accumulation with access early in the contract

- Access to more cash value, faster than traditional life insurance policies

- Low surrender charges so that clients will not face a severe financial penalty if they decide the policy no longer fits into their financial strategy

- Business owners looking to retain a key employee

- Deferred cash accumulation vehicle not tied to the market

- Estate planning

- Coverage for their entire life

- Estate planning

- To only pay a one-time premium

- Coverage and cash value guaranteed

- Tax-deferred growth and accumulation vehicle with exceptional safety and predictability

- A tax-advantaged way to pass on wealth

Who Should Consider A Term Conversion

- Anyone who wants to pay for their own final expenses

- Anyone who’s health has changed since their original term policy was issued

- An insured interested in a cash accumulation vehicle with safety and tax advantages

- Anyone who needs coverage for their entire life

- Need benefit amount of $250,000 or less

- Coverage for a specific period of time

- Do not want to go through a medical exam (blood and urine test)

- Easy and quick process to purchase insurance

Estate Maximizer is great for clients looking for the following:

- Seeking to increase an estate for their heirs

- To pay a single, lump-sum premium

- Coverage and cash value guarantee

- Tax-deferred growth and accumulation, under current tax law

- Ways to minimize tax burdens for beneficiaries

- Potential for market growth with an investment floor that can minimize downside risk

- Insurance coverage plus the benefit of cash value

- The ability to make premium payments in a flexible manner

- Tax deferred growth and accumulation

- To wait 15 or more years until first planned distribution

- The ability to add additional funds into the policy in expectation to increase cash value

- Cost-effective permanent coverage with potential for cash-value growth

- Insurance Coverage plus the benefit of potential cash value

- Largest amount of permanent death benefit for least amount of premium

- Willingness to accept risk of not having lifetime guarantee of values

- The ability to make premium payments in a flexible manner

- Tax-deferred growth and accumulation

This product may be great for clients looking for the following:

- Concerned regarding the potential cost of Long-Term Care expenses

- Want to protect their assets/estate

- Want a single premium product

- Death benefit if no long-term care is needed

- Concerned about return of premium

- Do not want to go through a medical exam (blood and urine test) for up to $500,000 of coverage

- Competitive rates

- Coverage for a specific period of time

- Quick and easy process to purchase life insurance

This product may be great for clients looking for the following:

- Concerned regarding the potential cost of Long-Term Care expenses

- Want to protect their assets/estate

- Want a single premium product

- Death benefit if no long-term care is needed

- Concerned about return of premium

This product may be great for clients looking for the following:

- Concerned regarding the potential cost of Long-Term Care expenses

- Want to protect their assets/estate

- Want a single premium product

- Death benefit if no long-term care is needed

- Concerned about return of premium

-

Protection - Clients who seek the security of tax-free benefit protection for their family, with optional coverage, that contains its

own fees, in case the insured suffers from a chronic or terminal illness.

-

Growth - Clients who are unhappy with the performance of their lower yielding assets, such as CDs, savings, and checking accounts, but

would like to put their money to work for higher returns.

-

Easy Access - Clients who want to know they can access their money without facing surrender charges, just in case they need it to work elsewhere.

-

Non-Correlated Asset - Clients who do not want to have their money tied to the volatility of market fluctuations.

The Ideal Client

Age: 40-70Net Worth: $500,000+

Investable Assets: $50,000+ in idle cash to use as a single-pay premium

Conservative Investors looking for safe alternatives in a low interest rate environment

Lifestyle: Healthy and active

Detailed Product Specifications

- Issue ages: 20 – 60 years

- Coverage amounts available: $25,000 - $350,000

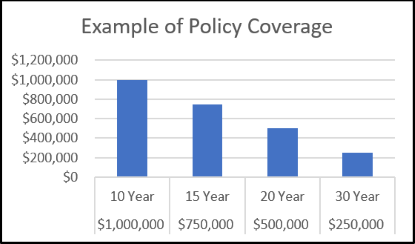

- Term length options: 10, 15, 20 and 30 years

- No medical exam required

- Renewable at the end of the term period

- Instant issue, online underwriting, where policy is approved in minutes

- Issue ages: 0 – 90 years

- Coverage amounts available: $25,000 - $10,000,000

- Flexible premium payments

- Offers long-term guaranteed death benefit to age 100 and beyond

- Various cash value accumulation features available

- Issue ages: 18 – 90 years

- Coverage amounts available: $25,000 - $10,000,000

- Lengths of term coverage available: 5, 10, 15, 20, 25, and 30 years

- Guaranteed, level premium payments for term of coverage

- Return of premium option available – your cost will be returned at the end of the coverage period

- Issue ages: 18-64 years

- Coverage amounts: $100,000-$3,000,000

- Possible abbreviated issue (non-med) up to $1,000,000 of coverage

- 3 underwriting processes available, depending on insured's health

- an offer for coverage with no need for a medical exam (Not all will qualify. Usually the healthiest individuals);

- an offer for temporary coverage with a need to take a medical exam to finalize your coverage offer;

- a request for a medical exam before an offer is made.

- When applying for over $1,000,000 of coverage, a medical exam will be ordered at no cost to the insured

- Lengths of term coverage available: 10, 15, 20 or 30 years

- Convertibility: No conversion options available

- Available riders

- Accelerated Death Benefit - allows terminally ill insured to receive an advance in their policy's death benefit while still living

- Guaranteed Renewability - allows insured to renew policy after term period has expired at a high rate without additional underwriting

- Haven Life Plus Rider - allows insured access to additional benefits the moment their policy is in force, such as

- Online platform for creating wills from Trust & Will

- Digital secure vault for storing and sharing important documents from LifeSite

- Discounted family health care services from MinuteClinic

- Rider not available in FL, NY, ND, SD, and WA.

- Please call one of our experts for a complete product specification guide

- Issue ages: 18-65 years

- Coverage amounts: $25,000-$500,000

- Additional product features

- No medical exam - issuing the policy or paying its benefits is based on your truthful answers to the health questions in the application

- Free look – new clients have up to 10 days to cancel their coverage for a full refund

- Accelerated Death Benefit rider included in the policy and may have fees when exercised

- Issue ages: 20 – 75

- Coverage amounts available: $100,000 and up

- Lengths of coverage available: 10, 15, 20, 25, 30, 35 and 40 years depending on age

- Term Rider lengths available: 10, 15, and 20 years

-

Up to 3 term riders can be added to a single product.

-

(Example; $250K 30-year term with $250K 10-year rider, $250K 15-year rider, and a $250K 20-year rider can be added to the policy to have a stepped down benefit as needs reduce over time)

-

(Example; $250K 30-year term with $250K 10-year rider, $250K 15-year rider, and a $250K 20-year rider can be added to the policy to have a stepped down benefit as needs reduce over time)

-

Accelerated death benefit, payable in the event of a qualifying terminal illness

- The maximum benefit amount is the lesser of $500,000 or 75% of the policy’s primary death benefit, less any policy loan

-

Conversion period: convertible for the duration of the guaranteed level premium period or up to attained age 70, whichever comes first

- Policies issued at age 66 or over are convertible during the first five policy years

- Child Rider and Waiver of Premium Rider also available

- Guaranteed, level premium payments for the term of coverage

- Issue ages: 0 - 85 years

- Coverage amounts available: $5,000 - $10,000,000

- Many payment types: single pay, 10 pay, pay to 65 and pay for lifetime

- Issue ages: 18-65 years

- For ages 55-65, there is additional electronic underwriting

- Coverage amounts available: $10,000 - $150,000

- Fixed premiums

- No medical exam required

- Instant issue underwriting policy approved in minutes

- Guaranteed interest rate: 4%

- Builds tax deferred cash value

- Issue ages: 50 – 85 years

- Coverage amounts available: $5,000 - $250,000

- Maximum Premium depends on insured’s age:

- Ages 50-59: $100,000

- Ages 60-64: $175,000

- Ages 65-80: $250,000

- Ages 81-85: $50,000

- Guaranteed coverage to age 120

- Guaranteed minimum interest rate on cash value

- Builds tax-deferred cash value

- The ability to take a loan on cash value at a net 2% interest rate

- 100% guaranteed return of premium, less withdrawals and loans if applicable, upon full surrender

- Decision based on answers to health questions in application. For most applications, no medical exam required

- Underwriting decisions received in minutes for most applications

- Includes Accelerated Death Benefit Agreement for early access to a portion of death benefit coverage in the event of terminal illness at no additional cost

- Issued by Minnesota Life Insurance, a Securian Company

- Issue ages: 18-70 years. Issue age will vary based on Face Amount and Level Premium Period selected

- Minimum coverage is $100,000

- Coverage of $249,999 and under does not require an exam and is dependent on issue age and Face Amount

- Lengths of term coverage available: 10, 15, 20, 30

- Guaranteed, level premium payments for term of coverage

- Generous conversion provision with a credit up to one year of annualized term insurance premiums applied to cash value of life insurance policy*

- Issue ages: 30-75 years

- Coverage amounts available: $60,000 - $600,000 *in most states

-

Inflation benefit options:

- 5% Compound Interest

- 5% Simple Interest

- 3% Simple Interest

- None

- Benefit period: 2 – 8 years*

- Underwriting classes only smoker and non-smoker

- Care coordination service

-

Elimination Period:

-

In-Home Care: 0 day

-

Services Include:

- Home Health Care

- Care Coordination

- Caregiving Training

- Home Modification

- Durable Medical Equipment

- Adult Day Care Facility

-

Services Include:

-

Facility Care: 90 days (do not have to be continuous and need only be satisfied once per lifetime)

-

Services Include:

- Nursing Home Facility

- Assisted Living Facility

- Facility Hospice Care

-

Services Include:

-

In-Home Care: 0 day

- Issue ages: 0 – 90 years

- Coverage amounts available: Varies based upon age

- 2% guarantee in fixed account with potential for non-guaranteed additional credit

- Highly compensated individuals earning $200,000 or more annually can potentially qualify for simplified underwriting up to a $3 million policy; meaning no medical exam is required, but instead underwriting is done with a client phone call

- Multiple options to optimize cash value potential

-

Multiple options to optimize cash value potential

- Beginning in year 3 potential for non-guaranteed credit and/or performance factor

- Benefit Distribution Rider: allows client to distribute death proceeds from 5 to 30 years reducing policy charges on a nonguaranteed basis. This features allows for greater growth and distribution potential

-

Multiple additional riders available

- Accelerated Death Benefit Rider for Long-Term Care

- Benefit Distribution Rider

- Issue ages: 18 – 80 years

-

Coverage amounts available: $100,000 and up

- Express issue up to $1,000,000 of coverage

- Lengths of term coverage available: 10, 15, and 20 years

- Convertibility: Convertible up to the end of the level term period or prior to insured’s attained age 70, whichever comes first

- Guaranteed, level premium payments for term of coverage

-

Available riders:

- Total Disability Waiver

- Accelerated Benefit

-

Unemployment Protection

- Waives premiums for up to 12 months if insured becomes unemployed

- Please call one of our experts for a complete product specifications guide

- Issue ages: 20 – 80 years

-

Coverage amounts available: $250,000 - $20,000,000

- Express issue up to $1,000,000 of coverage

- Lengths of term coverage available: 10, 15, and 20 years

- Convertibility: Enhanced conversion privilege plus the Conversion Extension rider gives clients additional flexibility to decide when they want to convert their policy

-

Vitality Program:

- Opportunity to reduce premiums by living a healthy lifestyle

- Personalized health goals and a free health tracking electronic device to track progress toward a healthy lifestyle

- Other discounts and rewards

-

Available riders:

- Total Disability Waiver

- Accelerated Benefit

-

Conversion Extension

- Extends the normal conversion period to the earlier of the last day of the Term Period or the policy anniversary nearest the life insured’s attainment of age 70

- Please call one of our experts for a complete product specifications guide

- Issue ages: 18 – 80 years

-

Coverage amounts available: $250,000 - $10,000,000

- Express issue up to $1,000,000 of coverage

- Lengths of term coverage available: 10, 15, 20, and 30 years

- Convertibility: Convertible up to the end of the level term period or prior to insured’s attained age 70, whichever comes first

-

Available riders:

- Waiver of Premium

- Accelerated Benefit

-

Children’s Term

- Up to $15,000 per child

- One rider charge, no additional cost per child

- Issue ages: 18 – 50 years

-

Coverage amounts available: $100,000 - $500,000

- Express issue up to $1,000,000 of coverage

- Lengths of term coverage available: 15, 20, and 30 years

- Convertibility: Convertible up to the end of the level term period or prior to insured’s attained age 70, whichever comes first

- Guaranteed, level premium payments for term of coverage

-

Available riders:

- Waiver of Premium

- Accelerated Benefit

-

Children’s Term

- Up to $15,000 per child

- One rider charge, no additional cost per child

- Issue ages: 20 – 85 years

-

Coverage amounts available: $100,000 - $5,000,000

- Express issue up to $1,000,000 of coverage

- Flexible premium payments

- Offers long-term guaranteed death benefit to age 121

-

Available riders:

- Accelerated Benefit

- Children’s Term

- Disability Waiver

- Guaranteed Insurability

- Spouse Term

- Please call one of our experts for a complete product specifications guide

- Issue ages: 0 – 90 years

-

Coverage amounts available: $100,000 and up

- Express issue up to $1,000,000 of coverage

- Flexible premium payments

- Offers long-term guaranteed death benefit to age 121

-

Available riders:

- Disability Payment of Specified Premium (DPSP)

- Accelerated Benefit

- Long-Term Care (LTC)

-

- Maximum monthly benefit amount is based on 1%, 2% or 4% of the policy death benefit elected at issue

- Please call one of our experts for a complete product specifications guide

*Exclusions, Exceptions, and Limitations: We will not pay benefits for any room and board, care, treatment, services, equipment, or other items for care or services: 1) provided by the Insured’s Immediate Family unless he or she is a regular employee of an organization which is providing the treatment, service or care; and the organization receives the payment for the treatment, service or care; 2) for which no charge is normally made in the absence of insurance; 3) provided outside the United States of America, except as described in the International Benefit; 4) that result from an attempt at suicide (while sane or insane) or an intentionally self-inflicted injury; 5) provided in a government facility (unless otherwise required by law); 6) for which benefits are available under Medicare (including amounts that would be reimbursable but for the application of a deductible or coinsurance amount) or other governmental program (except Medicaid), any state or federal workers’ compensation, employer’s liability or occupational disease law, or any motor vehicle no-fault law. No benefits will be paid for services received while the Accelerated Benefit Rider (ABR) for Long-Term Care and the Extended Benefit Rider (EBR) for Long-Term Care are not in force

- Issue ages: 30 – 75 years

- Benefit period: 2 – 8 years

- Minimum base face amount: $60,000 *in most states

- Maximum base face amount: $600,000

- Payment options: Single pay, 5 years, or 10 years

-

Inflation benefit options:

- 5% Compound Interest

- 5% Simple Interest

- 3% Simple Interest

- None

-

Long-term care minimum death benefit:

- 5% of the initial face amount, up to $5,000

-

Underwriting classes:

- Simplified issue, Sex-Distinct*in most states: Non-tobacco Single, Non-tobacco Couples, Tobacco Single, Tobacco Couples

- Care coordination service

-

Reimbursement Benefit Option or Indemnity Benefit Option must be selected at issue

- Indemnity option does reduce monthly max benefits by indemnity factor (please refer to product guide for details)

-

Elimination Period

- The policy covers all of the following services, submit to the specified elimination periods:

Elimination Period: Reimbursement Payment Option Elimination Period: Indemnity Payment Option 0 Days 90 Days 90 Days Home Health Care Nursing Home facility Home Health Care Care Coordination Assisted Living Facility Care Coordination Caregiving Training1 Facility Hospice Care Caregiver Training2 Home Modification1 Home Modification2 Durable Medical Equipment1 Durable Medical Equipment2 Adult Day Care Center Adult Day Care Center Nursing Home Facility Assisted Living Facility Facility Hospice Care Not subject to the Monthly Maximum Benefit-Reimbursement Payment Option amount but is subject to a separate lifetime maximum benefit amount. In Arizona, Massachusetts, Maryland, and Oregon, benefits for these services are limited to the monthly maximum benefit and have separate lifetime maximums.

Benefits for these services are limited to the Monthly Maximum Benefit-Indemnity Payment Option and have separate lifetime maximum in all states.

*Conversion credit is not available if the policy is converted in the first policy year. Conversion is available with a minimum of the first 5 policy years for all level premium periods. For 15, 20, and 30-year level premium periods, policy may convert up to 10 policy years, depending on the insured's issue age.

- Issue Ages: 14 days - 17 years

- Coverage amounts available: $10,000 - $75,000

- Coverage doubles at age 18

- Guaranteed interest rate of 4%

- Less than 50 cents a day for $25,000 of coverage

- Fixed premiums

- Opportunities to increase coverage up to 10 times the original amount without underwriting

- Issue ages: 18 years and older

- Coverage amounts available: $50,000 - $500,000

- No underwriting required

- Guaranteed issue: no medical questions are asked and there is not a medical exam required

- Premium rates will not increase with age

- Single and family coverage is available

- Issue ages: 18 – 60 years

- Coverage amounts available: $10,000 to $250,000

- Ages 55 – 60 years: $10,000 to $150,000

- Term Length options: 5, 10, 15, and 20 years

- No medical exam required

- Online underwriting

- Additional features

- Accelerated death benefit

- Conversion privilege

- Renewable at end of the term period

- Issue ages: 15 – 70 years

- Coverage amounts available: $25,000 - $10,000,000

- Lengths of term coverage available: 5, 10, 15, 20, 25, 30, and 35 years

- Guaranteed, level premium payments for term of coverage

- Return of premium option available – your cost will be returned at the end of the coverage period

Traditional Long-Term Care

- Issue ages: 18 – 79 years

- Benefit period: 1 – 6 years

- Monthly benefit amounts available: $1,500 - $15,000

- Elimination period: 0 - 365 days

- Payment duration: lifetime

- Return of premium available

- Tax advantages

- Exam usually required

- Issue ages: 18 – 60 years

- Coverage in place until age 65

- Coverage amount available: equal to your annual income up to $100,000

- Affordable fixed premium

- Covers both manual and non-manual jobs

- Pays lump sum benefit for total disability that is expected to last at least one year

- Policy terminates once claim payment is made

- Instant issue, online underwriting, where policy is approved in minutes

- Issue ages: 18 – 61 years

- Monthly benefit: up to $5,000 per month

- Elimination period: 0 – 90 days

- Benefit period: 3, 6, 12 or 24 months

- Premium rate is fixed until coverage ends at age 67

- Issue ages: 18 – 61 years

- Monthly benefit: up to $20,000

- Elimination period: 60, 90, 180, or 365 days

- Benefit period: 2 year, 5 year, to age 65 or to age 70

- Guaranteed level premium rates to age 65

The Term Conversion Process

- Complete eligibility form

- Choose new permanent product by signing desired illustration

- Execute conversion form

- Receive policy with no underwriting

Detailed Product Specifications

- Issue ages: 18 - 64 years

- Coverage available: $50,000-$5 million up to age 55; $250,000 minimum for ages 55-80

- Choose 10 or 20 year term coverage period

- Guaranteed, level premium payments for term of coverage

- Expedited underwriting with a dedicated team:

- For coverage amounts under $250,000, the e-application is followed by a telephone interview, as well as MIB, motor vehicle, and prescription database checks

- For coverage amounts of $250,000 - $750,000, the applicant will be required to undergo an exam, but no attending physician statements are required

- For coverage amounts of $750,000 - $5,000,000, regular underwriting will apply, but will be expedited with the e-application process

- Issue ages: 20 - 60 years

- Underwriting standard class will be issued at best class

- Coverage amounts available: $100,000 - $1,000,000

- For US residents only – minimum of 2 years residency

- For non-smokers only – no nicotine use within last 24 months

- Premium payments made only in first 10 years or less

- Telephone interview, but no medical exam required

- Issue ages: 0 - 85 years

- Coverage amounts available: $50,000 - $1,000,000

- Low surrender charges

- Payment duration less than 10 years

- Issue ages: 55 - 80 years

- Coverage amounts available: $25,000 - $150,000

- Guaranteed coverage to age 120

- Guaranteed minimum interest rate on cash value: 3%

- Builds tax-deferred cash value

- The ability to withdraw 10% of premium paid without a fee each policy year

- The ability to take a loan on cash value at a net 3% interest rate

- Return of premium available

- Issue ages: 20 - 60 years

- Underwriting standard class will be issued at best class

- Coverage amounts available: $100,000 - $1,000,000

- US residents – minimum of 2 years residency

- Non-smokers – no nicotine use within last 24 months

- High early cash value accumulation

- Telephone interview, no medical exam

- Low surrender charges

- Flexible Premiums

- Issue ages: 0-85 years

- Coverage amounts available: $50,000 - $1,000,000 +

- High early cash value accumulation

- Low surrender charges

- Flexible Premiums

- Issue Ages: 50 -85 (age last birthday)

-

Minimum Premium Amount: $15,000

- Maximum premium amounts available for abbreviated approval decision

-

Ages: 50-59 60-64 65-80 81-85 Min. Premium Amounts: $100,000 $175,000 $225,000 $40,000 (Larger premium amounts available with normal underwriting) - Cash value grows income tax-deferred

- Principal Guarantee: 100% of principal, less withdrawals and loans, is guaranteed upon full surrender [1]

- Income tax-free death benefit to beneficiaries, under current tax law

- Waiver of withdrawal charges – for qualifying medical stay: after first contract year, withdrawal charges are waived if the insured or insured’s spouse becomes confined to a qualified institution and is treated by a qualified medical professional for at least 45 days during a continuous 60-day period [2]

-

Access to Contract Values: [3]

-

Ability to take a policy loan on cash value:

- For the first 10 years of the contract, the policyholder may take a policy loan with a 5% charge and a 3% credit.

- After 10 years, all loans become preferred with the charge and credit being the same at 3%.

-

Ability to take a policy loan on cash value:

- Withdrawal Charges:

-

Years: 1 2 3 4 5 6 7 8+ Percentage: 4% 4% 4% 4% 3% 3% 2% 0% (as a percentage of single payment)

[2] Withdrawals and loans are subject to tax on any gain in the contract and, if taken before age 59½, may be subject to a 10% federal tax penalty. Loans, if not repaid, and withdrawals will reduce the death benefit and account value. Clients should consult a tax advisor.

[3] This benefit may vary or may not be available in some states.

- Issue ages: 0-85 years

- Coverage amounts available: $50,000 - $10,000,000

- Many payment types: very customizable

- Issue ages: 0 – 85 years

- Coverage amounts available: $25,000 - $10,000,000

- Many payment types: very customizable

- Issue ages: 30 – 75 years

- Coverage amounts available

-

Inflation benefit options:

- 5% Compound Interest

- 5% Simple Interest

- 3% Compound Interest

- 3% Simple Interest

- None

- Benefit period: 2 – 8 years

-

Underwriting classes:

- Smoker and Non-smoker

- Single and Married / domestic partnership

- Simplified Issue, Fluidless Underwriting

-

Covered Care Services – specific to each carrier’s product

- Please call the talk to an expert number in the upper right-hand corner

-

Elimination Period – specific to each carrier’s product

- Please call the talk to an expert number in the upper right-hand corner

- Issue ages: 18 – 60 years

- Coverage amounts: $100,000 and up

- No Medical exam required for up to $500,000 of coverage

- Lengths of term available: 10, 15, 20, 25 and 30 years

- Convertibility: Convertible up to the end of the level term period or prior to the insured’s attained age 70, whichever comes first

- Guaranteed, level premium payments for the term of coverage

- Available riders:

- Accelerated Death Benefit (No Premium Charge)

- Children’s Level Term

- Waiver of Premium

- Accidental Death Benefit

- Please call one of our experts for a complete product specifications guide

- Issue ages: 40 – 79 years

- Minimum base face amount: $50,000

-

Maximum base face amount:

- $500,000 with 2-year LABR (Long-Term Care Acceleration of Benefits Rider)

- $750,000 with 3-year LABR (Long-Term Care Acceleration of Benefits Rider)

-

Inflation benefit options:

- 5% Compound Interest

- 3% Compound Interest

- None

-

Long-term care minimum death benefit:

- 5% of the base face amount, up to $10,000

-

Underwriting classes:

- Simplified issue, Sex-Distinct: Non-tobacco Single, Non-tobacco Couples, Tobacco Single, Tobacco Couples

-

LTC benefit options:

- Initial LTC benefit period options: 2 or 3 years

- Extension of LTC benefit options: 2 or 4 years

- Elimination Period: 90 days

-

Covered Services:

- Home healthcare

- Assisted living

- Nursing home care

- Adult day care

- Hospice care

- Alternative care services

-

Additional Benefits:

- Bed reservation benefit

- International benefits

- Expenses are reimbursed up to 100% of monthly maximum benefit for all levels of care

-

Return of premium options available

- Option 1: 80% once all premiums are paid

- Option 2: 100% once all premiums are paid, according to vesting schedule below

Vesting Schedule: Year 1: 80% Year 4: 92% Year 2: 84% Year 5: 96% Year 3: 88% Year 6+: 100%

- Issue ages: 40 – 75 years

- Benefit period: 2-7 years

- Minimum base face amount: $50,000

- Payment options: Single pay, 5 years, or 10 years

-

Inflation benefit options:

- 5% Compound Interest

- 3% Compound Interest

- None

-

Long-term care minimum death benefit:

- 20% of the base face amount

-

Underwriting classes:

- Simplified issue, Sex-Distinct: Non-tobacco Single, Non-tobacco Couples, Tobacco Single, Tobacco Couples

- Elimination Period: 90 days

-

Benefits are cash indemnity

- Cash Indemnity on this product means benefits are paid up to the maximum monthly amount regardless of the actual cost of care.

Product Highlights

Please note: State variations may apply to all sections in this document.

For full details, see the policy for the relevant state.

| Risk Class | Issue Ages | Face Amounts |

|---|---|---|

| Standard Nonsmoker and Smoker | 21-85 |

|

|

|

|

| Death Benefit Options |

|

|

|

|

||

|

|

|

|

|

|

||

|

|

||

Who is National Life?

National Life Group, a Fortune 1000 company, serves 840,000 customers. With 2011 revenue of $1.5 billion and net income of $124 million, members of National Life Group employ roughly 900 employees, with most located at its home office in Montpelier, Vermont. Group companies also maintain offices in Addison, New York, and San Francisco. Life Insurance Company of the Southwest (LSW) is a member of the National Life Group. Life of the Southwest has an AM Best rating of A, which means Excellent.

Learn more about National Life Group here: https://www.nationallifegroup.com

Who is Legal & General?

Who Is Ameritas?

Our Mutual Advantage

Securian is an A+ or Superior rated company due to its impeccable financial strength and claims paying ability. Founded in 1880, their record of financial strength and claims paying ability position itself as one of the most highly rated companies in America. They are proud to protect clients nationwide with more than $1 trillion of life insurance in force.

Learn more about Securian Financial Group here: https://www.securian.com

Liberty Life Assurance Company of Boston is a Liberty Mutual company. Over the past 100 years, Liberty Mutual Insurance has been committed to helping people preserve and protect what they earn, build, own and cherish.

Who is Securian?

Learn more about Securian Financial Group here: https://www.securian.com

Who is Haven Life?

Visit https://havenlife.com/blog/best-life-insurance-companies/ for more information.

Who is MetLife?

MetLife is the largest life insurer in the United States.

Learn more about MetLife here: https://www.metlife.com

Who is Pacific Life?*

What is Prime Term?

*Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products

are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product

availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under

the products it issues. Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the

financial strength and claims-paying ability of the issuing insurance company. Look to the strength of the life insurance company with

regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency or their affiliates from which products

are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability

of the life insurance company. Pacific Life's Home Office is located in Newport Beach, CA.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance

or investment products. Only a life insurance producer who is also a fiduciary is required to advise if the product purchase and any subsequent

action taken with regard to the product are in their client’s best interest.

Who is Pacific Life?*

What is PremierCare Advantage?

*Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products

are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product

availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under

the products it issues. Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the

financial strength and claims-paying ability of the issuing insurance company. Look to the strength of the life insurance company with

regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency or their affiliates from which products

are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability

of the life insurance company. Pacific Life's Home Office is located in Newport Beach, CA.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance

or investment products. Only a life insurance producer who is also a fiduciary is required to advise if the product purchase and any subsequent

action taken with regard to the product are in their client’s best interest.

Who is Pacific Life?*

What is PremierCare Advantage?

*Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products

are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product

availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under

the products it issues. Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the

financial strength and claims-paying ability of the issuing insurance company. Look to the strength of the life insurance company with

regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency or their affiliates from which products

are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability

of the life insurance company. Pacific Life's Home Office is located in Newport Beach, CA.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance

or investment products. Only a life insurance producer who is also a fiduciary is required to advise if the product purchase and any subsequent

action taken with regard to the product are in their client’s best interest.

Who is Pacific Life?

What is Pacific Discovery Xelerator IUL?

- Is a life insurance policy designed for death benefit protection with competitive long-term cash value accumulation potential after policy year 15. This product illustrates well when funded with large premiums within the policy’s first 7 to 10 years. The PDX offers a simplified issue underwriting for select classes, and can go up to $3 million in coverage with this simplified underwriting process.

Who is John Hancock Financial?

Who is Lincoln Financial?

Who is SBLI (Saving Bank Life Insurance)?

Lincoln Financial was founded in 1905 and has focuses on supporting, preserving and enhancing people’s lifestyles and retirement outcomes. Lincoln’s core business areas are life insurance, annuities, retirement planning services and group protection.

Nationwide has been helping people protect what’s important for more than 85 years. It started as once a small mutual auto insurer in Ohio, and has now grown to one of the largest insurance companies in the world. Nationwide remains a mutual company owned by its policyholders, and has more than $158 billion in statutory assets.

A/Excellent

Total Assets $224B

Even though we’re new, we’re one of the largest annuity and life insurance providers in the U.S.

Insurance Policies & Annuity Contracts 2.7M

Many people trust us to protect their families and secure their financial futures.

General Account Investments & Cash $84.2B

Our future strength and long-term stability is rooted in a disciplined risk management strategy.

This checklist helps identify who is a good candidate for PAUL. If the Proposed Insured answers YES to any of the questions below, they may not qualify for coverage under the PAUL product.

Brighthouse Simple Underwriting is available on single-premium PAUL cases for issue ages 21-65 for face amounts up to $2,500,000 and for ages 66-75 for face amounts up to $1,000,000.

In the past 3 years, has the Proposed Insured:

Been declined or rated for Life Insurance coverage?

Been scheduled for surgery or non-routine medical tests that are not yet completed, or been evaluated for an undiagnosed condition?

Had a conviction for driving under the influence, or had his/her license suspended?

Had a seizure disorder resulting in two or more seizures a year, or been diagnosed with a seizure disorder in the last 24 months?

Received disability payments (excluding pregnancy)?

Required home health services for daily living activities, or been confined to a nursing home?

Sustained two or more falls, or used an assistive walking device?

In the past 10 years, has the Proposed Insured:

Been diagnosed with HIV/AIDS?

Been followed or treated for a heart disorder (including: heart attack, heart failure, heart enlargement, heart surgery of any kind, or atrial fibrillation)?

Been treated for an autoimmune disease requiring daily steroid therapy or more than one biologic agent or immunosuppressant (including: rheumatoid or psoriatic arthritis and lupus)?

Had chronic liver disorder, excluding fatty liver (including: cirrhosis of the liver, chronic or active hepatitis B or C, pancreatitis, or other chronic liver diseases)?

Had chronic obstructive pulmonary disease (COPD) or emphysema?

Had chronic pain treated with prescription medication?

Had a circulatory disorder resulting from smoking or diabetes?

Had a cognitive disorder, including Alzheimer’s disease, dementia, or memory loss?

Had a mental disorder requiring three or more prescription medications, or had thoughts of suicide?

In the past 10 years, has the Proposed Insured:

Had Crohn’s disease or ulcerative colitis requiring prescription medication?

Had insulin dependent diabetes?

Received an organ transplant?

Seen or been treated by a Nephrologist for any chronic kidney diseases?

Seen or been treated by a Neurologist for any neurological disorder related to: stroke, carotid artery disease, Parkinson’s disease, multiple sclerosis, muscular dystrophy, ALS/Lou Gehrig’s disease, or Huntington’s disease?

Seen or been treated by an Oncologist or Hematologist for cancer, leukemia, lymphoma, or blood disorder?

Over the past 10 years, has the Proposed Insured had a history of:

Alcohol or drug abuse?

Felony conviction or is he/she currently on parole?

Using illicit drugs (other than marijuana) or prescription narcotics in amounts other than as prescribed?

All No’s? Work with your financial professional to apply today!

What is Lump Sum Disability Insurance?

What is SI Term Life Insurance?

What is Universal Life Insurance?

What is Term Life Insurance?

What is Term Life Insurance?

- Term life insurance is life insurance that provides death benefit at a fixed cost for a specific period of time, usually 5, 10, 15, 20 or 30 years. Term insurance is the least expensive way to purchase coverage over a specific period of time.

What is Whole Life Insurance?

What is Asset Based LTC?

Asset based policies are commonly referred to as Hybrid, Universal Life Insurance with LTC benefits. These policies provide a flexible LTC benefit while still providing a death benefit, return of premium features, and access to cash value. The policies long-term care benefit is limited to a maximum amount but the premiums will never increase. When long-term care is needed, the life insurance death benefit or annuity value is accessed to pay for qualifying expenses (your care). The asset based policies have a death benefit payout that is made to beneficiaries at the time of death if the policy has not been exhausted for long-term care expenses. The premiums are usually guaranteed, meaning the policy will never be exposed to an increase in cost.

What is Asset Based Long-Term Care?

Asset based policies are commonly referred to as Hybrid LTC/Life. These policies provide a flexible LTC benefit while still providing a death benefit, return of premium features, and access to cash value. The policies long-term care benefit is limited to a specific amount but the premiums will never increase. When long-term care is needed, the life insurance death benefit or annuity value is accessed to pay for qualifying expenses (your care). The asset based policies have a death benefit payout that is made to beneficiaries at the time of death if the policy has not been exhausted for long-term care expenses. The premiums are usually guaranteed, meaning the policy will never be exposed to an increase in cost.

What is Long-Term Care Insurance?

What is long-term disability insurance?

What is short-term disability insurance?

What is SBA Term Life Insurance?

- Many SBA lenders require borrowers to have life insurance to serve as collateral for the loans

- We offer an online application process specifically for SBA borrowers

- The application and collateral assignment is completed online, where the bank required collateral assignment paperwork is included in the e-application and is e-signed with the application

- The expedited underwriting process ensures that the purchase of life insurance does not hold up the loan closing process

What is Accidental Death Insurance?

What is SI Term Life Insurance?

What is Single Premium Whole Life?

What is 10 Pay Whole Life?

What is PAUL?

What is Single Premium Universal Life?

What is a Term Conversion?

- Changing your existing coverage to a product that will last your entire life and guarantee a payout

- Policy holders can convert their term policy to a permanent policy without any underwriting, simply completing a conversion form

- Most clients' policies expire without them ever realizing that they had the opportunity to convert

- Term owners can convert all or just a portion of their existing death benefit

- Most people need life insurance and most people want their coverage to last their whole life. The issue in the marketplace is once most insureds decide this it is too late and/or too expensive to find a product

- Many term policies have the ability to convert the existing policy into a permanent product

- Converting to permanent policy guarantees coverage for your entire life, along with having the ability to build savings in the cash value component in a tax-efficient manner

- Converting the policy ensures that you will have coverage, even if your health status has changed

What is Estate Maximizer?

[1] Liberty Life Assurance Company of Boston’s financial strength backs all of its obligations to pay claims under the policies it issues. In addition, Liberty Life Assurance Company of Boston’s ability to pay those claims is backed by a written guarantee from Liberty Mutual Insurance Company.

[2] Withdrawals and loans are subject to tax on any gain in the contract and, if taken before age 59½, may be subject to a 10% federal tax penalty. Loans, if not repaid, and withdrawals will reduce the death benefit and account value. Clients should consult a tax advisor.

Product Disclosure

Liberty Life Assurance Company of Boston, a Liberty Mutual company, issues Liberty Series Estate Maximizer Next Generation, a single payment interest-sensitive whole life insurance contract, on policy forms SPWL-2010157, ICC10-SPWL-2010157 as applicable (SPWL-2010157 NY in New York) and state variations identified by state code. Contract availability, terms, conditions and issue limitations may vary by state. Home office: Boston, Mass. Service center: Dover, N.H.

What is Index Universal Life?

What is Current Assumption Universal Life?

What is Asset Based LTC?

- Asset based long-term care insurance is insurance to help provide the cost of chronic illnesses, disabilities or other conditions that need assistance over an extended period of time. This insurance would help provide skilled care from nurses, therapists, or other professionals for daily living activities such as bathing, dressing, and eating.

- Asset based policies are commonly referred to as Hybrid, Universal Life Insurance with LTC benefits. These policies provide a flexible LTC benefit while still providing a death benefit, return of premium features, and access to cash value. The policies long-term care benefit is limited to a maximum amount but the premiums will never increase. When long-term care is needed, the life insurance death benefit or annuity value is accessed to pay for qualifying expenses (your care). The asset based policies have a death benefit payout that is made to beneficiaries at the time of death if the policy has not been exhausted for long-term care expenses. The premiums are usually guaranteed, meaning the policy will never be exposed to an increase in cost.

What is SBLI Term Insurance?

What is Asset Based LTC?

- Asset based long-term care insurance is insurance to help provide the cost of chronic illnesses, disabilities or other conditions that need assistance over an extended period of time. This insurance would help provide skilled care from nurses, therapists, or other professionals for daily living activities such as bathing, dressing, and eating.

- Asset based policies are commonly referred to as Hybrid, Universal Life Insurance with LTC benefits. These policies provide a flexible LTC benefit while still providing a death benefit, return of premium features, and access to cash value. The policies long-term care benefit is limited to a maximum amount but the premiums will never increase. When long-term care is needed, the life insurance death benefit or annuity value is accessed to pay for qualifying expenses (your care). The asset based policies have a death benefit payout that is made to beneficiaries at the time of death if the policy has not been exhausted for long-term care expenses. The premiums are usually guaranteed, meaning the policy will never be exposed to an increase in cost.

What is Asset Based LTC?

- Asset based long-term care insurance is insurance to help provide the cost of chronic illnesses, disabilities or other conditions that need assistance over an extended period of time. This insurance would help provide skilled care from nurses, therapists, or other professionals for daily living activities such as bathing, dressing, and eating.

- Asset based policies are commonly referred to as Hybrid, Universal Life Insurance with LTC benefits. These policies provide a flexible LTC benefit while still providing a death benefit, return of premium features, and access to cash value. The policies long-term care benefit is limited to a maximum amount but the premiums will never increase. When long-term care is needed, the life insurance death benefit or annuity value is accessed to pay for qualifying expenses (your care). The asset based policies have a death benefit payout that is made to beneficiaries at the time of death if the policy has not been exhausted for long-term care expenses. The premiums are usually guaranteed, meaning the policy will never be exposed to an increase in cost.

What is Universal Life Insurance?

On the protection side, it generally includes a tax-free death benefit to your loved ones and has an optional feature that gives you the ability to access your policy values to help pay for costs should the insured suffer from a chronic or terminal illness, just in case.

On the growth side, PAUL helps you generate returns and has no surrender charges — in case you need your money to work for you elsewhere.

This is the best of both worlds – protection and growth in one product.

Funding Options

-

Self-funding with personal assets

-

Pros

- If no long-term care expense arises cost is $0

- Assets saved on insurance can be invested

-

Cons

- Any long-term care expenses will be funded through distributions from financial assets

- Your household may assume full risk of costs that could run into seven digits

- Potential investment risk for underlying portfolio

- Possible difficulty managing assets should a long-term care need arise

- Your household assumes full risk of costs that could run into seven digits

- Investment risk for underlying portfolio

- Difficulty managing assets should a long-term care need arise

- Could force family members to care for you, which can create additional hardships

-

Pros

-

Medicaid

-

Pros

- Available to those with little savings

- Can be used after other resources have been liquidated

-

Cons

- Could require relative poverty to qualify

- Reimbursement to facilities can be generally lower than costs, so Medicaid recipients may receive lower quality care

- Requires relative poverty to qualify

- Reimbursement to facilities is generally lower than costs, so Medicaid recipients may receive lower quality care

-

Pros

-

Traditional long-term care insurance

-

Pros

- Can minimize household risk

- Minimizes house-hold risk

- Can minimize house-hold risk

- Premiums may be tax-deductible

- Premiums may be tax deductible

-

Cons

- If it ends up unused, could be viewed as a waste of money

- Premium increases may occur

- Can be difficult to predict coverage

- Patient could be left to pay for items not covered

- Possibility of inadvertent lapsing

- Historically unmanageable premium increases

- Difficult to predict coverage

- Patient left to pay for items not covered

- Inadvertent lapsing

-

Pros

-

Asset based long-term care insurance

-

Pros

- Typically provides upfront premium guarantee against future premium increases and the risk of inadvertent lapsing

- Death benefit can be available if long-term care insurance is not needed

- Long-term care coverage is typically leveraged by a “high deductible” as the policy’s cash value is spent first

- Generally, fewer underwriting requirements than traditional long-term care insurance

-

Cons

- Large upfront premiums can remove assets from investment portfolio

- If interest rates rise, policy interest rates may fail to keep up

-

Pros

- Upfront premiums guarantee against future premium increases and the risk of inadvertent lapsing

- Death benefit available if long-term care insurance is not needed

- Long-term care coverage is leveraged by a “high deductible” as the policy’s cash value is spent first

- Fewer underwriting requirements than traditional long-term care insurance

-

Cons

- Large upfront premium removes assets from investment portfolio

- If interest rates rise, policy interest rates may fail to keep up

-

Pros

If the answer is No for all of the following questions, then your client is eligible for this product.

In the past 12 months, has your client been unable to actively perform all the duties of your regular occupation (including homemaker or student); been admitted to a long-term care facility; been confined to a bed for more than 14 days; received care or been hospitalized for a fall; or been unable to perform, without assistance, the routine activities of daily living (bathing, dressing, transferring, mobility, toileting, feeding)?

Has your client ever received medication for, been diagnosed by a medical professional, or tested positive for: Human Immunodeficiency Virus (HIV) or Acquired Immune Deficiency Syndrome (AIDS)?

In the past 10 years, has your client received any treatment, medical advice by a medical professional, had a consultation for, been diagnosed with:

- Coronary artery disease; heart disease; or heart attack?

- Heart valve disease?

- Disorders of the blood (excluding high blood pressure and high cholesterol); circulatory system requiring a surgical procedure; heart enlargement; use of a pacemaker or implanted defibrillator; or aneurysm?

- Stroke; carotid artery disease requiring a surgical procedure; peripheral vascular disease requiring a surgical procedure; Alzheimer’s disease; dementia, amyotrophic lateral sclerosis (ALS); Parkinson’s; disorder of the immune system?

- Diabetes?

- Kidney disorder?

- Cancer, including, but not limited to, leukemia and lymphoma (excluding basal cell or squamous cell carcinoma of the skin)?

- Emphysema; chronic obstructive pulmonary disease (COPD); oxygen use?

- Cirrhosis; alcohol or drug abuse; major depression; bipolar disease; schizophrenia?

Purchasing This Product Can Be Simple

Applying For Estate Maximizer Can Be Simple

- Provide basic information to get an accurate and instant quote

- Complete a simple online application that includes personal and health questions

- It's so easy that the entire process can be completed in minutes

- Provide basic information to get an accurate and instant quote

- Complete a simple online application that includes personal and health questions

- It's so easy that the entire process can be completed in minutes

- Complete a short set of questions, then depending on various electronic checks, the client will go into one of the following underwriting processes:

- First option when applying for less than $1,000,000 of coverage is to be approved instantly with no further underwriting required.

- Second option would be a phone call from Haven Life to go into further information and ask some medical questions.

- Third option would be a phone call from Haven Life to go into further information and ask some medical questions and schedule a medical exam.

- You can also give one of our experts a call at your convenience.

- Complete a short set of questions, then depending on various electronic checks, the client will go into one of the following underwriting processes:

- First option when applying for less than $1,000,000 of coverage is to be approved instantly with no further underwriting required.

- Second option would be a phone call from Haven Life to go into further information and ask some medical questions.

- Third option would be a phone call from Haven Life to go into further information and ask some medical questions and schedule a medical exam.

- You can also give one of our experts a call at your convenience.

- Provide basic information to get an accurate and instant quote

- Complete a simple online application that includes personal and health questions

- Underwriting decision received in minutes for most applications

- It’s so easy that the entire process can be completed in minutes

- You can also give one of our experts a call at your convenience

You can also give one of our experts a call at your convenience.

You can also give one of our experts a call at your convenience.

- Simply complete the online questions, then Legal & General will reach out to your client to complete a telephone history interview which will complete the application process

-

There are two possibilities during underwriting:

- First option is your client qualifies for express issue underwriting and no medical exam will be required

- Second option is your client does not qualify for express issue underwriting and Legal & General will setup and schedule a medical exam with the client

- You can also give one of our experts a call at your convenience

You can also give one of our experts a call at your convenience.

You can also give one of our experts a call at your convenience.

Simply complete the online application and your policy will be approved in minutes and the policy will be sent to you right away.

You can also give one of our experts a call at your convenience.

You can also give one of our experts a call at your convenience.

You can also give one of our experts a call at your convenience.

You can also give one of our experts a call at your convenience.

- Provide basic information to get an accurate and instant quote

- Complete a simple online application that includes personal and health questions

- It's so easy that the entire process can be completed in minutes

- You can also give one of our experts a call at your convenience

- Provide basic information to get an accurate and instant quote

- Complete a simple online application that includes personal and health questions for you and the child

- It's so easy that the entire process can be completed in minutes

- Provide basic information to get an accurate and instant quote

- Fill out one short set of questions with your personal information

- It's so easy that the entire process can be completed in minutes

- You can always give one of our experts a call at your convenience if you have any questions

- Provide basic information to get an accurate and instant quote

- Complete a simple online application that includes personal and health questions

- You can always give one of our insurance experts a call

- Request an illustration

- Review the illustration with your client and have them sign the illustration

- Scan and submit the signed illustration via the interface

- Complete the simple online application that includes health questions

- MetLife will follow up with a 20-40 minute telephone interview

- Simply complete a short set of questions, then Pacific Life will reach out to your client for a telephone history interview which will complete the application process. Pacific Life will schedule the necessary requirement such as a medical exam if required which is at no cost to you

- You can also give one of our experts a call at your convenience

- Asset based LTC requires a brief phone interview and no medical exam

- Request an illustration

- Review the illustration with your client and have them sign the illustration

- Can submit the signed illustration via the interface